Managing Whole Life Insurance Nonforfeiture Options

By John Blocher

Product Matters!, April 2025

Insurers selling whole life insurance frequently offer nonforfeiture options down to the first dollar of Cash Surrender Value (CSV) for Reduced Paid Up (RPU) or Extended Term Insurance (ETI). Each of these options is actuarially equivalent from a policyholder perspective when premium cessation occurs. However, over the remaining life of the policy, ETI and RPU are not actuarially equivalent from the insurer perspective when expenses are considered. ETI is significantly more advantageous than RPU, especially when the CSV is small at the time of premium cessation.

An insurer might consider taking potential management actions individually or together to enhance the potential profitability of RPU or ETI conversion:

- File new life insurance products excluding RPU as a nonforfeiture option. Since no specific nonforfeiture option is required other than CSV, RPU doesn’t need to be offered, and many policyholders may prefer CSV. For any single premium life policy with no future premium, CSV is the only nonforfeiture option.

- Set ETI as the default nonforfeiture option. With a default set to ETI, no new RPU policies would be issued unless a policyholder specifically requests RPU.

- Offer CSV to policyholders with a small RPU face amount policy. This is the same CSV amount available anytime the CSV is positive. This may involve a special mailing and is typically done as cleanup after limiting or eliminating new RPU policies. Many policyholders who are reminded that a CSV is available may prefer CSV.

- If RPU is offered, maintain a minimum RPU face amount, where the RPU nonforfeiture option is only available when the RPU policy reaches the minimum RPU face amount. The minimum can be written into policy forms or established as company practice or both.

Actions one and two are straightforward and might be considered standard strategies for dealing with this issue.

Action three aims to reduce the number of existing small RPU policies. The insurer notifies the policyholder that a CSV is available upon request. An accurate mailing address and the CSV amount for each policyholder is required. This effort may be able to be coordinated with existing statements sent to the policyholder, emphasizing that a CSV is available. Many times, this action is not taken because of the lack of a good mailing address or other overhead required to make the CSV offer. If implemented, monitor the take rate to ensure this action continues to be worthwhile, if completed in phases.

Action four requires analyzing and establishing a minimum RPU face amount. An RPU policy at the minimum RPU face amount theoretically should be at least as profitable as paying the CSV. In other words, the minimum RPU face amount policy should not result in a loss against the expenses the RPU policy will incur in the future compared to paying the CSV upon premium cessation. This minimum serves as a floor, not a goal.

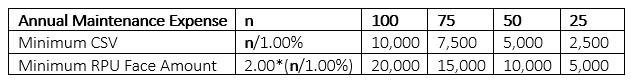

Various methods can be used to set a minimum RPU face amount. A positive CSV might develop prior to full recovery of issue and acquisition expenses, so an insurer may want to recover some of the acquisition expenses out of the RPU policy. For simplicity, assume acquisition expenses are all recovered by the time of premium cessation and the only need is to cover ongoing maintenance expenses out of the interest margin. Assuming the following:

- No acquisition expenses to recover.

- Annual maintenance expense for an RPU policy.

- Portion of interest spread available to pay annual maintenance expenses is 1.00%.

- The average RPU Face to CSV ratio is 2.00.

Under these assumptions, the minimum RPU face amount is directly related to annual maintenance expense coverage is listed in Table 1.

Table 1

Minimum RPU Face Amount depending on Assumptions

Every insurer might use different assumptions. Once an insurer sets a minimum RPU face amount, if a request for RPU would result in an RPU face amount below the minimum, RPU is not available for that policy and another available nonforfeiture option must be chosen (or default used). Most likely the policy will instead be set to ETI. This can be authorized by company practice or described directly in the policy form or both. The insurer should adopt a single minimum RPU face amount that is consistent across all whole life products and distribution channels and avoid frequent change to ensure consistent messaging to policyholders over time.

RPU defends against policyholders taking the CSV from one policy to pay for a single premium policy with a different insurer. It is no longer common to find a new issue face amount available in the U.S. below $5,000, thus $5,000 might be considered a starting place for a minimum RPU face amount.

Another reasonableness check for a minimum RPU face amount is that a death benefit at the minimum should be enough to have a meaningful purpose. For example, the National Funeral Directors Association 2024 Cremation and Burial Report lists a median cost of $6,280 for funeral with cremation and $8,300 for funeral with viewing and burial (not including the cost of a plot). A death benefit should be meaningful even when it is not designated for a specific expense. Those are the current costs, not the inflation-adjusted costs in the future when the death benefit amount is available.

An expense sometimes ignored is the requirement to periodically check for a death against the Social Security Limited Access Death Master File (LADMF). For ETI, the LADMF check only is required through a period a little past ETI expiry to ensure death didn’t occur during the ETI period, where for RPU the check is required for life until a death is reported.

A few more points on checking for deaths against the LADMF:

- Around 35% of the industry is still only scanning the LADMF.

- Most LADMF vendors also offer supplemental death data sources, but insurers are slow to utilize them since they are not currently required to be compliant.

- While most vendors offer supplemental death data like obituaries, they often still fall well short of the approximately 3 million deaths that occur each year in the U.S.

- Scanning frequency is also important to paying death benefits in a timely manner and to reduce interest and overpayment expenses.

- An optimal approach is to scan a variety of sources along with the LADMF and run frequent scans (potentially monthly, weekly or daily) to catch deaths as soon as possible.

Other considerations may also be relevant in making decisions about life insurance nonforfeiture options:

- An insurer usually charges an annual policy fee that may cover some of the annual maintenance expenses while the policy is premium paying. When the premium payments stop the policy fee revenue stops while the annual maintenance expense continues.

- The difference between the near certainty of a death claim processing expense for an RPU policy compared to a much less likely death claim processing expense for an ETI policy is sometimes overlooked.

- Check any proposed management action with compliance to ensure nothing proposed is contradictory to policy form language. Indicate in any filing of a product where RPU is available, tables of values on policy pages that RPU is not available below the minimum usually by showing zeros or dashes in the appropriate column until the RPU face amount is high enough that RPU is available.

- It is possible for a premium-paying non-Modified Endowment Contract (MEC) policy to become a MEC upon conversion to RPU, especially if premium cessation occurs during the first seven policy years. The policy must be retested against the 7-pay test upon conversion to RPU, though not upon conversion to ETI.

- In business that is participating, ETI is usually non-participating, while RPU is usually participating. Thus, the existing dividend scale is slightly protected when ETI is emphasized over RPU by using a minimum RPU face amount.

An insurer may improve profitability on their whole life block of business by reducing expenses through taking some or all the described management actions. Taking management actions to limit or prevent tiny RPU policies may also increase the franchise value of the whole life block of business and may help an insurer continue to offer the smaller face amount life insurance that some policyholders in the marketplace need.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

John Blocher, FSA, MAAA, is chief risk officer, vice-president & actuary at Liberty Bankers Life Insurance Co. He can be reached at john.blocher@lbig.com.