LTC Rate Increase Landscape Update

By Cassi Noel and Courtney Williamson

Long-Term Care News, April 2025

Long-term care (LTC) rate increases have been commonplace in the industry for nearly 20 years. However, there is wide variation among jurisdictions in their regulations and rate review practices. Furthermore, the rate increase landscape for carriers has evolved over the years due to changing regulations and actuarial review methodologies such that navigating the process can be challenging.

In April 2022, the National Association of Insurance Commissioners (NAIC) adopted the first version of the Multi-State Actuarial (MSA) framework.[1] As stated in the framework, “The NAIC charged the Long-Term Care Insurance (EX) Task Force with developing a consistent national approach for reviewing current long-term care insurance (LTCI) rates that results in actuarially appropriate increases being granted by the states in a timely manner and eliminates cross-state rate subsidization.” However, at the time of this writing, updates to the MSA framework are being proposed with notable changes from the April 2022 version.

In an effort to help carriers understand the rate increase environment, Milliman conducted a survey of LTC carriers regarding their recent rate increase experience. The 2024 survey was the third iteration, with prior surveys conducted in 2021 and 2016. Seventeen companies, representing over 75% of LTC premium in the United States, participated in the 2024 survey. The respondents included carriers with both large and small market shares. Of the responding companies, 16 provided detailed information on 37 nationwide rate increase filings, comprising more than 1,000 submissions to individual jurisdictions. Please note that, where comparisons between the 2021 and 2024 surveys are discussed, the comparison may be impacted by differences in the mix of business reflected in each survey (i.e., different companies and/or blocks of business).

Full survey findings will be available publicly on Milliman’s website in April 2025. This article provides some highlights from the full report.

Actuarial Assumptions and Modeling

Since the COVID-19 pandemic, regulators and carriers have considered whether to incorporate experience during the 2020–2022 period (COVID data) in setting their assumptions. If COVID data are included, regulators and carriers have contemplated whether to normalize the experience. The majority of carriers in our survey excluded COVID data from their most recent experience study. Of the carriers that did include COVID data, several only included the experience for certain assumptions. As we continue to move away from the height of the COVID-19 pandemic and LTC experience returns toward pre-pandemic patterns, more carriers are incorporating post-pandemic experience into their assumptions where they feel it represents future expectations.

Roughly half of respondents reported using a claim-cost model, with the other half using a first-principles model; this is consistent with the results of the 2021 survey.

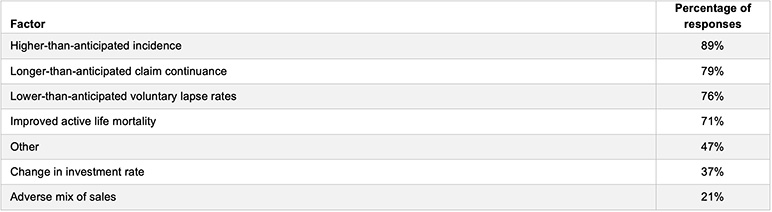

Several factors were identified as driving the need for rate increases. The most common was a combination of higher-than-anticipated claim incidence, longer-than-anticipated claim continuance, lower-than-anticipated voluntary lapse rates and improved active life mortality, as shown in Table 1.

Table 1

Factors Comprising the Rate Increase Actuarial Justification

Note: Responses total more than 100% as more than one factor may apply.

Requested Rate Increases

The average rate increase request for all submissions in the 2024 survey was 56%, which is higher than the 47% average from the 2021 survey. Cumulative requested rate increases continue to vary greatly among jurisdictions and blocks, with levels frequently exceeding 400%. Approximately 80% of filings requested the rate increase the company indicated was needed, which likely contributed to the large cumulative increases. Although there is no regulatory definition of what increase is needed, the most common methods used were the Prospective Present Value analysis, as defined in the MSA framework, and targeting a lifetime loss ratio.

Seventy-five percent of the filings referenced in the 2024 survey requested a rate increase that varied across benefit characteristics. The most common variations were by benefit period and/or inflation protection. This is an increase from the 56% of filings that requested a varied rate increase in the 2021 survey. In our experience, carriers request varied increases to target segments of the business that are underperforming and because many jurisdictions prefer rate increases to vary.

Filing Outcomes

The average time to approval for filings in the 2024 survey (i.e., submission to disposition) was six months, which was slightly shorter than the average seven-month time frame in the 2021 survey. The amount of time to reach approval varies widely across jurisdictions, as some departments approve rate increases quickly while others have a more involved process, asking a variety of actuarial and non-actuarial questions. Consistent with the 2021 survey, respondents identified California, Florida, New Jersey, New York and Texas as requiring the most effort. Connecticut and New Jersey were also identified as having more involved processes, replacing Maine and Montana from the 2021 survey. Although not specified by respondents, possible reasons a jurisdiction may be thought to require significant effort are the complexity of initial submission requirements, the amount of additional requested information and the extent of non-actuarial requirements (e.g., notification letters).

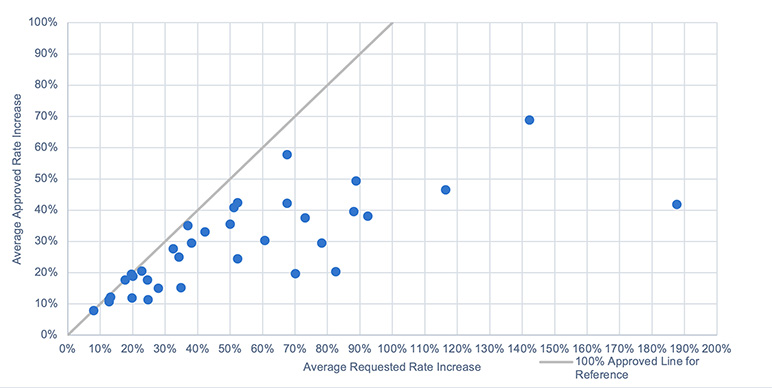

Like the 2021 survey, some jurisdictions (e.g., Wisconsin and Wyoming) do approve most, if not all, of a requested increase, and others (e.g., Nebraska and Texas) are willing to approve increases greater than 100%. However, most large increases are phased in, often at the request of regulators. Overall, the 2024 survey’s average approval was 28%, which is consistent with the 29% average from the 2021 survey. Where jurisdictions have limited or disapproved rate increases, respondents most commonly cited non-actuarial limits as the reason for a reduced approval or disapproval; however, some jurisdictions (e.g., Maryland) have regulatory restrictions on the increase amount in a given year. The authors have recently seen an increase in the number of jurisdictions implementing rate increase approval limitations, requiring phased-in increases and/or requiring rate guarantees as part of negotiations between departments of insurance and carriers.

Figure 1 provides the average nationwide rate increase request versus the average rate increase approved where a disposition has been received for each filing (including 0% for disapprovals). The diagonal line reflects full approvals of the requested rate increase by filing for reference. Note that jurisdictions may approve a rate increase greater than the request in exchange for a rate guarantee or phase-in.

Figure 1

Average Rate Increase Approved by Average Requested Increase

Reduced Benefit Options and Contingent Benefit upon Lapse

As an alternative to accepting a rate increase, companies often offer policyholders reduced benefit options (RBOs). Most companies allowed insureds to reduce the daily benefit amount, reduce the benefit period, increase the elimination period, and reduce or remove inflation protection. Several companies offered more innovative RBOs such as cash buyouts, coinsurance and landing spots. However, most companies that offered the cash buyout indicated it was only offered in certain jurisdictions. Relative to the 2021 survey, we observed an increase in the number of carriers offering innovative RBOs.

Companies may also offer policyholders a contingent benefit upon lapse (CBUL) option. A CBUL allows the policy to become paid up (i.e., no future premium payments are due) in exchange for a smaller benefit. This smaller benefit is typically a function of the premiums paid to date less any benefits received. The average RBO and CBUL election rate in the 2024 survey of impacted policyholders was 11.9% and 2.0%, respectively. These rates differ from the average 10.6% RBO and 3.8% CBUL election rates in the 2021 survey.

Several factors may be driving the change in RBO and CBUL elections from 2021 to 2024 (in addition to the variation across companies):

- Magnitude of the average approved increase: The approval amount can directly impact the number of policyholders electing RBOs and CBUL.

- Number and magnitude of prior increases: The quantity and total amount of prior rate increases can also impact elections. For example, higher cumulative increases may result in more policyholders electing RBOs.

- Number of RBOs offered: Higher RBO election rates may be due to the greater number of options made available to policyholders; this could also result in a reduction to the CBUL rate.

- Degree to which CBUL is offered: CBUL is required for some policies under regulations. Many carriers offer CBUL to all insureds, regardless of the regulatory requirements; however, there was a decrease in the availability of CBUL in the 2024 survey compared to the 2021 survey.

- Presentation of RBO and CBUL options to policyholders: As described in the next section, carriers have taken different approaches to how these options are presented to policyholders in notification letters, which can impact the policyholders’ behavior.

- Presence of innovative RBOs: Election of innovative RBOs can also be impacted if the innovative RBOs were offered during a prior increase. For example, carriers may have previously offered a landing spot that allowed insureds to reduce benefit periods and/or inflation protection options that were not available at the time of purchase. However, the election of these landing spots may restrict what RBOs are available in future rate increases.

Policyholder Notification Letters

A checklist for premium increase communications was originally adopted by the NAIC LTCI Reduced Benefit Options (EX) Subgroup in November 2021 and was amended in March 2023.[2] While most jurisdictions do not yet require each of the items outlined on the checklist, an increasing number require that the policyholder notification letter associated with each rate increase be filed for review. For rate increases that are phased in, most carriers send a letter prior to each implementation phase.

Carriers take different approaches in their notification letters to present RBOs and, if offered, CBUL. Some carriers provide a checkbox form that lists several available RBOs with details regarding the resulting premium and benefit reductions, including the CBUL, whereas other carriers simply provide a list of what options may be available with a customer service number.

Considerations for the Future

Beyond the current snapshot of LTC rate increases provided by the 2024 survey, we note the following potential developments that may play into the future landscape of LTC rate increases.

MSA Review Process

A few companies in our survey indicated they pursued rate increases through the MSA. Some of these carriers received faster and/or larger approvals as a result of this process. However, the current proposed changes to the framework may impact the number of carriers filing through the MSA.

Review Methodology Changes

Regulator review methodologies vary greatly by jurisdiction and are constantly evolving. In Washington state, for example, the Office of the Insurance Commissioner frequently updates its Speed to Market Tools for Long Term Care Rate Filings. From our experience, providing the information requested in this document has resulted in shorter review periods and fewer additional requests. California also has a checklist for LTC rate increase filings that is frequently updated.

New York has recently made a significant change to its methodology. In 2023, the New York Department of Financial Services (DFS) released a report detailing the history of the LTC market and how it may have historically evaluated LTC rate increases too conservatively for various reasons, as outlined throughout.[3] The report went on to outline the ramifications of DFS’s past approach and how it will be approaching future LTC rate increase filings differently. From the authors’ recent experience (but not reflected in the survey results), we have seen New York willing to approve large increases phased in over multiple years.

In-force Management

In addition to increasing rates, some companies are seeking alternatives to manage their LTC blocks of business. Just under half of the 2024 survey respondents indicated they use wellness initiatives, and two additional respondents reported they are not yet taking any specific measures but are currently exploring wellness programs. Wellness programs can have many different designs, with the goal of improving insureds’ quality of life and mitigating or delaying claims.[4]

What’s Next?

Although carriers are seeking alternative ways to manage their LTC blocks, rate increases continue to be a critical component. As evidenced by the 2024 survey, there is a wide range of methodologies and experience across jurisdictions. We believe the insights provided by this summary and the full report (available in April 2025) will illuminate recent rate increase-related trends, as well as opportunities for the industry to shape the efficiency and effectiveness of the filing process.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Society of Actuaries, the editors, or the respective authors’ employers.

Cassi Noel, ASA, MAAA, is an associate actuary at Milliman. Cassi can be reached at cassi.noel@milliman.com.

Courtney Williamson, ASA, MAAA, is an associate actuary at Milliman. Courtney can be reached at courtney.williamson@milliman.com.

Endnotes

[1] National Association of Insurance Commissioners, “Long-Term Care Insurance Multistate Rate Review Framework,” NAIC, Apr. 2022, https://content.naic.org/sites/default/files/documents/ltci-msa-framework.pdf.

[2] National Association of Insurance Commissioners, “Checklist for Premium Increase Communications,” 2023, https://content.naic.org/sites/default/files/committee_related_documents/LTC%2528EX%2529TF_RBO_Communication_Checklist_3.13.23%2520Adopted.docx (Microsoft Word download).

[3] New York Department of Financial Services, “Long-Term Care Insurance: Looking Back and Thinking Ahead,” New York State, June 7, 2023, https://www.dfs.ny.gov/system/files/documents/2023/06/dfs_ltc_report_20230607.pdf.

[4] Juliet M. Spector and Jeff Anderson, “Long-Term Care Wellness Initiatives: Key Components of Building and Evaluating a Sustainable Program” [Milliman report], Aug. 2024, https://edge.sitecorecloud.io/millimaninc5660-milliman6442-prod27d5-0001/media/Milliman/PDFs/2024-Articles/8-6-24_LTC-Wellness-Initiatives.pdf.